Free cash flow plays a crucial metric for investors and analysts. It highlights the actual cash generated by a corporation after accounting for its operating expenses and capital expenditures. Understanding free cash flow empowers investors to assess a company's financial health, viability, and its ability to generate profits.

This comprehensive guide examines the intricacies of free cash flow, defining its formula and offering valuable insights into its relevance for decision-makers.

Through clear explanations and real-world examples, you'll acquire a strong understanding of how to interpret free cash flow effectively.

Whether you're a seasoned investor or just initiating your journey into the world of finance, this guide will equip you with the expertise to make more informed investment decisions.

Decoding Free Cash Flow Calculation: Step-by-Step

Free cash flow (FCF) is a crucial metric for assess a company's financial health and its ability to generate capital. Calculating FCF can seem complex, but with a structured approach, it becomes a simple process.

- First identifying the company's net income from its earnings report.

- Subsequently, modify net income for non-cash expenses such as depreciation and amortization.

- Additionally, include changes in operational assets.

- Ultimately, subtract capital spending to arrive at the final FCF figure.

By utilizing these guidelines, you can accurately determine a company's free cash flow and gain valuable insights into its financial performance.

Examining Free Cash Flow: Metrics for Investment Success

Free cash flow (FCF) acts as a crucial metric for investors seeking to assess the health of a company. It represents the capital a company earns after paying its operating expenses and capital expenditures. A strong FCF signifies a company's ability to grow in the future, refund debt, or yield value to investors.

Understanding FCF can provide valuable information for making strategic purchase decisions.

Several key variables influence a company's FCF, including its operating margin, capital expenditures, and working funds. Studying these factors can help analysts recognize companies with consistent FCF generation, a sign of long-term growth.

Ultimately, by decoding the nuances of free cash flow, investors can develop more profitable investment decisions and position themselves for capital progress.

Unlocking Value with Free Cash Flow Analysis

Free cash flow (FCF) analysis provides a potent lens for evaluating the financial health and viability of businesses. By examining a company's ability to create cash flow from its activities, investors have the ability to determine its capacity to allocate resources for future growth, pay off debt obligations, and get more info yield value to shareholders.

A robust FCF analysis requires a thorough study of a company's earnings report, balance sheet, and cash flow statement. With carefully analyzing these financial documents, investors can uncover key insights into a company's performance, financial leverage, and future potential.

Consequently, FCF analysis serves as a valuable tool for evaluating investment choices. Companies with consistently strong FCF creation tend to be more sustainable and appealing to investors.

Understanding Free Cash Flow: The Key to Investment Success

Free cash flow (FCF) is a fundamental metric that reveals the financial health and potential of a business. Simply put, FCF represents the cash generated by a company after accounting for operating expenses and capital expenditures. By analyzing FCF, investors can gain valuable insights into a company's profitability, growth prospects. A strong and consistent free cash flow indicates that a company is effectively managing its operations, generating profits, and reinvesting in growth.

- Investors frequently rely on FCF to assess a company's financial strength

- Monitoring FCF over time can provide valuable insights into a company's operational efficiency

- In addition, FCF analysis can help investors identify companies that are mispriced

Ultimately, understanding free cash flow is crucial for making informed investment decisions. By incorporating FCF into their analysis, investors can make better-equipped understanding of a company's true value and potential.

Unveiling the Secrets of Free Cash Flow Projection

Predicting free cash flow (FCF) is a crucial technique for investors and businesses alike. It involves a delicate blend of quantitative rigor and creative insight. A robust FCF projection requires a deep understanding of a company's operations, its industry dynamics, and the broader economic landscape. Experts employ various techniques to forecast FCF, including discounted cash flow (DCF) analysis, regression models, and comparative analysis. The accuracy of these projections depends on a multitude of factors, such as the quality of information, the complexity of the business, and the accuracy of the premises made.

Effectively forecasting FCF is a multifaceted challenge that demands both analytical expertise and a keen sense of market acumen. By carefully evaluating historical trends, recognizing key drivers, and making informed assumptions, analysts can generate valuable insights into a company's future cash flow potential. This information is instrumental for investors in making investment decisions and for businesses in planning their strategies.

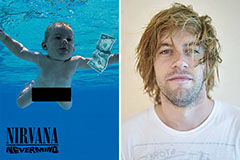

Spencer Elden Then & Now!

Spencer Elden Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!